These securities are essential investment classes and are favorites of major corporations. As noted in the below picture, Microsoft has more than 50% of its Total Assets as Short Term Investments or Marketable Securities. Therefore, it does not evaluate the profitability of a company as it does not consider all costs or revenues. For instance, if a company realizes that it will have a cash shortfall in the next month, it can take steps to ensure enough funds are available. The changes in the value of cash balance due to fluctuations in foreign currency exchange rates amount to $143 million.

Is the Indirect Method of the Cash Flow Statement Better Than the Direct Method?

In this section of the cash flow statement, there can be a wide range of items listed and included, so it’s important to know how investing activities are handled in accounting. Marketable debt securities are considered to be any short-term bond issued by a public company held by another company. Marketable debt securities are normally held by a company in lieu of cash, so it’s even more important that there is an established secondary market.

Cash Flow From Investing Activities Explained: Types and Examples

Interest income from debt securities, such as bonds, is generally taxed as ordinary income, impacting the overall tax burden for investors. Tax-exempt bonds, like municipal bonds, offer an attractive option for investors seeking to minimize taxable income, as the interest earned is often exempt from federal and sometimes state taxes. Equity securities represent ownership in a corporation, typically in the form of stocks. Common stocks grant shareholders voting rights and potential dividends, while preferred stocks offer fixed dividends but usually lack voting rights. These securities are traded on stock exchanges, providing liquidity and the potential for capital appreciation. Investors often choose equity securities for their growth potential, although they come with higher risk compared to debt securities.

Accounting and Valuation Techniques

Negative Cash Flow from investing activities means that a company is investing in capital assets. As the value of these assets increases, the amount of net Cash Flow available to the company over time increases. The income statement reports the revenue and expenditure of a company during a specific period, while the balance sheet reports the assets, liabilities, and capital. Marketable securities come in various forms, each with unique characteristics and benefits. These can be broadly categorized into equity securities, debt securities, and hybrid securities, each serving different investment needs and risk profiles.

As these technologies continue to develop, they will likely have profound implications for how marketable securities are issued, traded, and regulated. Before we answer that question, let us look at another marketable securities example. Apple, the most valued company of wall street, maintains a massive pile of these securities. Company X Inc. invests in US Treasury bonds having a maturity duration of 30 years in the financial year 2016. The company’s financial controller, Mr. Adam Smith, is in a dilemma as to whether those investments are to be classified as these securities or not.

- For instance, if a company purchases shares of stock, the initial recognition would include the purchase price of the shares plus any brokerage fees.

- Valuation of marketable securities is also crucial during the due diligence phase of M&A.

- In accounting, investment activities refer to the purchase and sale of long-term assets and other business investments, within a specific reporting period.

- The most widely used method is the present value approach, which discounts future cash flows—interest payments and principal repayment—back to their present value using an appropriate discount rate.

- In all cases, net Program Fees must be paid in full (in US Dollars) to complete registration.

Investing activities include purchases of physical assets, investments in securities, or the sale of securities or assets. Investments can be made to generate income on their own, or they may be long-term investments in the health or performance of the company. The net cash used in investing activities was calculated by subtracting the positive cash flow of $1,395 million from the negative cash flow of $25,431 million. As you’ll see below, the statement is separated into three parts, where investing activities come in between operating activities and financing activities.

Treasury bills are short-term government securities with maturities of one year or less, offering a safe investment with lower returns. Debt securities are generally considered lower risk compared to equity securities, but they are not entirely risk-free. The cash flow statement is one of the most revealing documents of a firm’s financial statements, but it is often overlooked.

When investors and analysts want to know how much a company spends on PPE, they can look for the sources and uses of funds in the investing section of the cash flow statement. Overall, the cash flow taxing working statement provides an account of the cash used in operations, including working capital, financing, and investing. The CFI section of a company’s statement of Cash Flows includes cash paid for PPE.

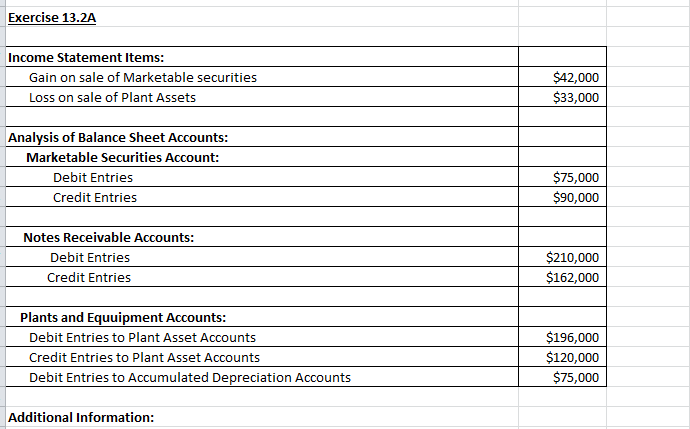

This treatment separates the impact of market fluctuations from the company’s operational performance, offering a clearer picture of core business activities. When these securities are sold, the accumulated gains or losses in OCI are reclassified to the income statement, ensuring that the financial impact is eventually recognized in earnings. Cash flow statements also capture the impact of marketable securities, particularly in the investing activities section. Purchases and sales of these securities are recorded as cash outflows and inflows, respectively.

It’s important to note that cash flow is different from profit, which is why a cash flow statement is often interpreted together with other financial documents, such as a balance sheet and income statement. Ideally, a company’s cash from operating income should routinely exceed its net income, because a positive cash flow speaks to a company’s ability to remain solvent and grow its operations. For non-finance professionals, understanding the concepts behind a cash flow statement and other financial documents can be challenging.